Don’t be bamboozled. Believing these myths could hurt your bottom line.

Key takeaways

- Establish good saving habits. Be sure to save some money from every paycheck.

- Invest your savings appropriately for your goals and time frame.

- Debt isn’t always bad but must be used responsibly.

There is no shortage of bad information out there—and falling for some of it can cost you money. It could be other people who steer you in the wrong direction, or it could be the things you tell yourself. Whatever the source, believing these myths could be hazardous to your financial health.

Get the truth behind these bits of financial misinformation.

Myth #1: All debt is bad.

In reality: It’s true that carrying a balance on your credit card or a high-interest loan can cost a lot—significantly more than the amount you initially borrowed. But not all debt will hold you back. In fact, certain types of debt, like mortgages and student loans, could help you move forward in life and achieve your personal goals.

They’re often thought of as “good” debt because the debt is funding an investment—a home or an education, which can be financially beneficial. The interest rates on mortgages and student loans are typically much lower than those on personal loans or credit cards, and the interest may be tax deductible. Even so-called “bad” debt like using a high interest rate credit card can be beneficial in some cases. Note that it is possible to take on too much good debt. (See Myth #3 below.)

No matter what kind of debt you take on, make sure you shop around for the best rates and never borrow more than you can afford to pay back on time.

Myth #2: It’s not worth saving if I can only contribute a small amount.

In reality: If you start early, around age 25, saving 15% of your paycheck—including your employer’s match to your RRSP if you have one—could help you save enough to maintain your current way of life in retirement. It sounds like a lot, but don’t lose your motivation if you can’t save that much. Don’t be discouraged if you start later than age 25. Beginning to save right now and gradually increasing the amount you’re able to put away can help you hit your goals.

Save as much as you can while still being able to pay for essentials like rent, bills, and groceries. Think of it this way—running a marathon is an impressive accomplishment, but that doesn’t mean a 3-mile run isn’t worthwhile!

Myth #3: Credit cards should be avoided.

In reality: As long as you pay off your card balance in full each month to avoid interest, making purchases with credit can be worthwhile. Many credit cards offer a rewards program. If you make all your everyday purchases with your card, you could quickly rack up points you can redeem for cash, travel, electronics, or to invest.

Also, demonstrating that you use credit responsibly can help you increase your credit score, making it easier to buy a car or a home later on. It may even earn you a lower interest rate when you borrow in the future.

It can be difficult to dig out of credit card debt, but if you control your spending and pay the card off every month, it could pay you back.

Myth #4: The stock market is too risky for my retirement money.

In reality: It’s true that money in a savings account is safe from volatility—unlike money invested in the stock market. But it won’t grow much either, given that current interest rates on savings accounts are so low. When it’s time to withdraw that money for retirement a few decades from now, your money won’t buy as much because of inflation. The stock market, however, has a long history of growth, making it a more appropriate choice for most or part of your savings in the long term.

For instance, for a young person investing for retirement, a diversified investment strategy based on your time horizon, financial situation, and risk tolerance could provide the level of growth you need to achieve your goals. You don’t need to invest only in stocks to benefit from stock market growth though. Choosing a diversified investment mix of stocks and adding securities such as bond mutual funds or certificates of deposit, which historically have not moved in lockstep with stocks, can reduce the overall level of risk in your portfolio. That means

you usually won’t experience as much volatility in your investment mix as with an all-stock portfolio.

There are a variety of ways to invest. Building a diversified portfolio based on your needs and the length of time you plan to be invested can be as complicated or as simple as you prefer. You can build your own portfolio with mutual funds or exchange-traded funds—or even individual securities.

If you find investing daunting or don’t have the time to figure it out just yet, you might consider a managed account or a target-date fund for savings that are earmarked for retirement. With a target-date fund, you pick the fund with the target year closest to when you want to retire. The target-date fund manager selects, monitors, and adjusts the investment mix to match the target retirement date. With a managed account, you answer questions about yourself and why you’re investing, and investment professionals build a portfolio around your goals and then work with you to keep it on track. Whatever gets you into the market and helps you stay there could be better in the long run than procrastinating and suffering the lost opportunity of not being invested.

Myth #5: I’m young, so I don’t need to save for retirement now.

In reality: It’s tempting to put off preparing for retirement while you work on paying off student loans, saving for a house, and putting kids through school. These goals feel immediate, while retirement is so far away.

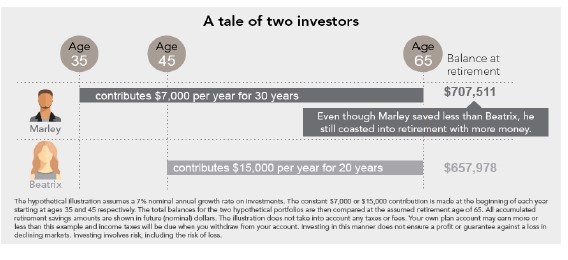

But having time on your side can actually be one of the best reasons to start saving for retirement now. That’s because you may not be considering the opportunity cost of not being in the market.

Compounding happens when you earn interest or dividends on your investments. As interest is reinvested, the value of your investments grows—because the value is slightly higher, it earns even more interest, which is then packed back into the investments and it grows even more. Over time, the value can snowball because more dollars are available to benefit from potential capital appreciation. But time is the secret ingredient—if you aren’t able to start saving early in your career you may have to save a lot more in order to make up for the value of lost time.

You can start by contributing to your RRSP or other workplace savings plan. If your employer matches your contributions, make sure you contribute up to the match—otherwise you’re basically giving up free money. If you don’t have a workplace retirement account, don’t worry. You’re in good company. Many people don’t have the option, but you still have options for saving for retirement. Consider opening an TFSA to get started.

Myth #6: There’s no way of knowing how much money I’ll need in retirement.

In reality: How much you’ll need depends entirely on your situation and what you plan to do when you leave the workplace. It’s pretty likely that your lifestyle could change dramatically between age 25 and 65, so it may be hard to picture how you’ll live in retirement or how much money will be required.

But Fidelity did the math and came up with some guidelines. Aim to save at least 15% of your pretax income every year—including employer contributions. To see if you’re on track, use our savings factor: Aim to have saved at least 1x (times) your income at 30, 3x at 40, 7x at 55, and 10x at 67. Of course, everyone’s situation is unique and you may find that you need to save more or less than this suggestion.

Don’t worry if you’re not always on track. Saving consistently, increasing your contributions when you’re able, and investing for growth in a diversified mix of investments could help you catch up over time. The important thing is to keep saving and investing no matter what life throws at you through the course of your career.

*Any view or opinion expressed in this video are solely those of the Representative and do not necessarily represent those of Harbourfront Wealth Management Inc. The information contained herein was obtained from sources believed to be reliable, however accuracy is not guaranteed. The information transmitted is intended to provide general guidance on matters of interest for the personal use of the viewer, who accepts full responsibility for its use, and is not to be considered a definitive analysis of the law or factual situations of any individual or entity. Any asset classes featured in this presentation are for illustration purposes only and should not be viewed as a solicitation to buy or sell. Past performance does not necessarily predict future performance, and each asset class has its own risks. As such, this content should not be used as a substitute for consultation with a professional tax or legal expert, or professional advisors. Prior to making any decision or taking any action, you should consult with a licensed professional advisor.